Are you planning on buying a home? Do you know which are the different types of home loans available for you and do you know which are the types of home loans for first-time buyers? With the increase in the rates of properties, the demand for home loans has increased. To address the demand for home loans, banks, and other financial institutions offer home loans

In this article, we shall discuss what is a home loan, what are the different types of home loans available, what are the types of home loans for first-time buyers, what is the eligibility criteria to get home loans, and what are documents required to purchase home loans.

What Is A Home Loan ?

A home loan is also known as a mortgage loan is a type of loan which an individual borrows from a bank and other financial institutions. The borrower is required to pay back the loan amount plus interest in Easy Monthly Instalments (EMIs) over a period of time that can range from 10 to 30 years depending on the type of loan borrowed.

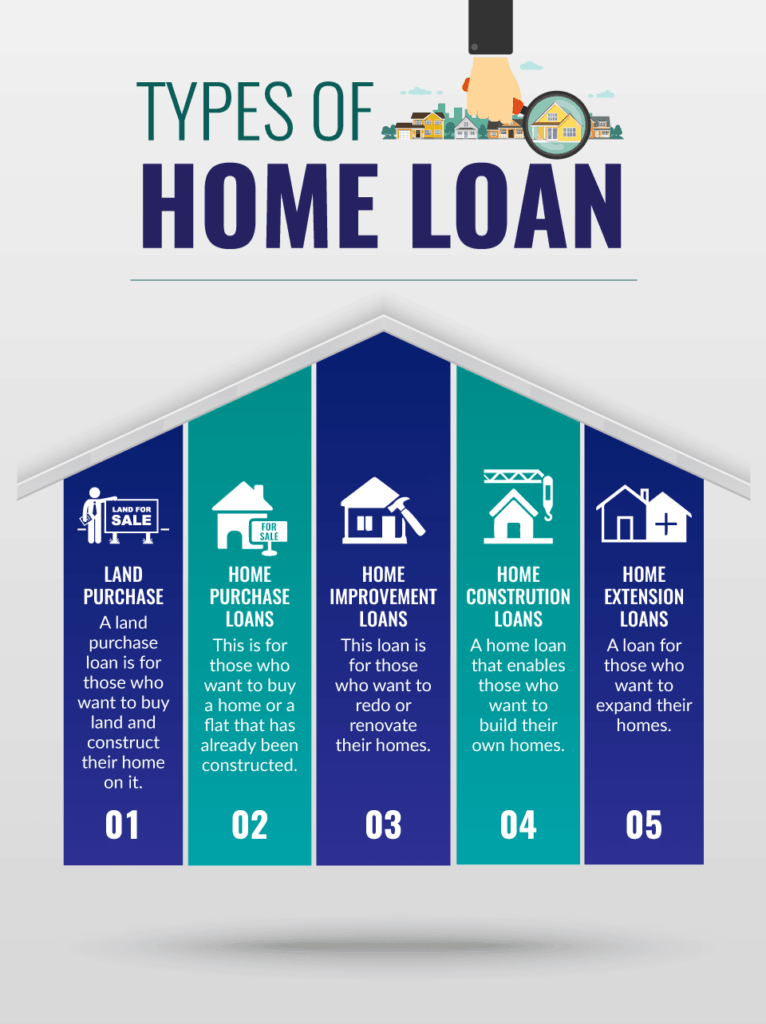

Which are the Different Types Of Home Loans

A home loan can be purchased by an individual based on his needs and affordability, mentioned below are the different types of home loans available to you.

1. Home Purchase Loans

A home purchase loan is a type of home loan that is used to buy a residential property, such as an apartment, home, or bungalow. The maximum loan amount provided by banks is 90% of the property’s current market value. This figure is 80% for Non-Banking Financial Companies (NBFCs).

Eligibility Criteria For Home Purchase Loans

The following are the eligibility criteria for salaried professionals and self-employed individuals to avail of home purchase loans.

- The age eligibility for salaried professionals and self-employed individuals has to be within 18-65 years.

- A salaried professional must have a work experience of 2 years and a self-employed individual needs to have a minimum of 5 years of work experience.

- The credit score required by both individuals has to be 750 and above.

Documents Required For Home Purchase Loans

Mentioned below is the list of the documents which are required for home purchase loans.

- Age-proof documents such as birth certificate, class 10 mark sheet, etc.

- Address-proof documents such as Aadhar Card, Voter ID, utility bills, etc.

- Income-proof documents such as salary slips and income tax return details.

- Identification proof documents, any Government-issued identity proof such as Aadhar Card, Pan Card, Voter ID, and Passport.

- Existing loan documents.

- Documents related to the property to be purchased.

2. Home Construction Loan

A home construction loan is a type of home loan that is taken by the landowner to construct a home. A home construction loan can also be used to complete the construction of an incomplete home. When applying for a home construction loan, the most significant requirement is that the plot must be purchased within a year in order for the plot cost to be included in the loan amount.

Eligibility Criteria For Home Construction Loan

The following are the eligibility criteria for salaried professionals and self-employed individuals to avail of a home construction loan.

- The age eligibility for salaried professionals and self-employed individuals has to be within 18-65 years.

- A salaried professional needs to have a minimum of 1 year of experience with his current employer. A home construction loan is available to all professional and non-professional self-employed individuals.

- The credit score required for both individuals is 700 and above.

Documents Required For Home Construction Loan

Mentioned below is the list of the documents which are required for home construction loans.

- Age proof documents such as birth certificate, class 10 mark sheet, etc.

- Address proof documents such as Aadhar Card, Voter ID, utility bills, etc.

- Income proof documents such as salary slips and income tax return details.

- Identification proof documents, any Government-issued identity proof such as Aadhar Card, Pan Card, Voter ID, and Passport.

- Existing loan documents.

- Documents related to the property to be purchased.

3. Home Improvement Loans

=

A home improvement loan is a type of loan which is taken for home improvement. Renovation and repair activities such as external and interior repair, painting, above-water tank construction, and electrical repairs, among other home improvements, can be done with this type of loan. Home improvement loans are very popular among loan buyers due to the very low-interest rate.

Eligibility Criteria For Home Improvement Loans

The following are the eligibility criteria for salaried professionals and self-employed individuals to avail of home improvement loans.

- The age eligibility for salaried professionals and self-employed individuals has to be within 18-65 years.

- It is available for both salaried and self-employed individuals who already own a home.

Documents Required For Home Improvement Loans

Mentioned below is the list of the documents which are required for home improvement loans.

- Age proof documents such as birth certificate, class 10 mark sheet, etc.

- Address proof documents such as Aadhar Card, Voter ID, utility bills, etc.

- Income proof documents such as salary slips and income tax return details.

- Identification proof documents, any Government-issued identity proof such as Aadhar Card, Pan Card, Voter ID, and Passport.

- Original property title deeds.

- Estimated quotation of the improvement and renovation.

4. Home Extension Loan

This type of loan is taken when a homeowner wants to extend his home or add more space to his home. For example, constructing a new room or adding a balcony.

Eligibility Criteria For Home Extension Loan

- The age of the borrower must be within 18-65 years old to be eligible for a home extension loan.

- This type of loan is available for both salaried and self-employed individuals who already own a home.

Documents Required For Home Extension Loan

Mentioned below is the list of the documents which are required for a home extension loan-

- Age proof documents such as birth certificate, class 10 mark sheet, etc.

- Address proof documents such as Aadhar Card, Voter ID, utility bills, etc.

- Income proof documents such as salary slips and income tax return details.

- Identification proof documents, any Government-issued identity proof such as Aadhar Card, Pan Card, Voter ID, and Passport.

- Existing loan documents.

- Documents related to the home extension.

5. Land Purchase Loans

Land purchase loans are loans that are used to purchase land. Several institutions provide land purchase loans. Buying land is a versatile choice; the buyer may save money and build a house whenever his finances allow, or he can keep the land as an investment.

Eligibility Criteria For Land Purchase Loans

- The age of borrower must be within 18-65 years old to be eligible for a land purchase loan.

- This type of loan is available for both salaried and self-employed individuals who already own a home.

Documents Required For Land Purchase Loans

Mentioned below is the list of the documents which are required for land purchase loans-

- Age proof documents such as birth certificate, class 10 mark sheet, etc.

- Address proof documents such as Aadhar Card, Voter ID, utility bills, etc.

- Income proof documents such as salary slips and income tax return details.

- Identification proof documents, any Government-issued identity proof such as Aadhar Card, Pan Card, Voter ID, and Passport.

- Existing loan documents.

Documents related to the property to be purchased

6. NRI Home Loans

Non-Resident Indians can make use of NRI home loans to build a new house or renovate an existing property in India. The life of the loan is for a maximum term of 30 years, and the interest rate can be a fixed rate of interest or a variable rate of interest.

Eligibility Criteria For NRI Home Loans

- The age eligibility criteria for an NRI to buy a home loan is 18-60 years of age.

- The employment eligibility criteria for salaried individuals or self-employed individuals is at least 2 years of work experience in the present company where they are working.

Documents Required For NRI Home Loans

Mentioned below is the list of the documents which are required for an NRI to apply for NRI home loans.

- Passport and work visa copy.

- Proof of valid work permit.

- Copy of employment contract.

- Current overseas residential proof.

- Salary slips of the past three months.

- Salary account statement for the past six months.

- General power of attorney.

- The income tax returns of the previous years, except for Non-Resident Indians residing in the countries of the middle east and those who are working for the merchant navy.

- Papers and other documents of the property.

7. Balance Transfer Home Loans

Individuals who want to transfer an existing home loan from one provider or lender to another might use a home loan balance transfer. The main motivation for taking up this type of home loan is the reduced interest rate offered by the new lender, as well as the possibility of a top-up facility. This is done so that the remaining loan may be repaid at the updated, lower interest rates given by the other lender.

Eligibility Criteria For Balance Transfer Home Loans

- The age eligibility criteria for balance transfer home loans is that an individual needs to be within the age group of 18-60 years.

- The employment eligibility criteria for salaried and self-employed individuals to avail a balance transfer home loan is that they should have a clear past record of timely repayments with the previous lender.

Documents Required For Balance Transfer Home Loans

Mentioned below is the list of the documents which are required for balance transfer home loans.

- Age-proof documents such as birth certificate, class 10 mark sheet, etc.

- Address-proof documents such as Aadhar Card, Voter ID, utility bills, etc.

- Income-proof documents such as salary slips and income tax return details.

- Bank statement indicating repayment of the continuing home loan.

- Documents and papers related to the property.

- The loan statements and other property-related documents in the possession of the present lender.

8. Bridge Loan

A bridge loan is a type of home loan taken out by persons who want to buy another property after selling their current property. The fund assists in meeting short-term money requirements, such as a down payment on a new house while the old one is not sold. Bridge loans are often given at higher interest rates with payback terms of up to two years.

Eligibility Criteria For Bridge Loan

- The age eligibility criteria for a bridge loan is that an individual needs to be within the age group of 18-70 years.

- All property owners and co-applicants are eligible to apply for a bridge loan.

Documents Required For Bridge Loan

Mentioned below is the list of the documents which are required to apply for a bridge loan.

- Age-proof documents such as birth certificate, class 10 mark sheet, etc.

- Address-proof documents such as Aadhar Card, Voter ID, utility bills, etc.

- Income-proof documents such as salary slips and income tax return details.

- Bank statement indicating repayment of the continuing home loan.

- Documents and papers related to the property.

9. Joint Home Loan

A joint home loan is taken by two individuals. Usually, when someone takes a home loan, it put a great deal of financial pressure on a single person. With joint home loans, this financial responsibility is shared equally between co-applicants.

Eligibility Criteria For Joint Home Loans

The following are the eligibility criteria for joint home loans:

- Applicants can apply for this type of loan with a:

- Parent

- Spouse

- Son, if the applicant has multiple heirs and is the primary owner

- Daughter, Is she is the primary owner and she is unmarried

- Applicants must be a resident of India

- The age of the applicant must be between 23 and 62 years.

Documents Required for Joint Home Loan

Mentioned below is the list of the documents which are required for joint home loans:

- KYC documents – driving license, passport, voter ID card (If any), aadhaar card

- Salary slips of the last 2 months

- Employee ID card

- Bank account statements of last 3 months for salaried employees and 6 months for self-employed individuals

- Proof of business of minimum 5 years (for self-employed individuals/businessmen)

It’s a very well-written doc. I could barely find anything. This is all I could find.

Closing Thoughts – Types Of Home Loans For First-Time Buyers

The above-mentioned home loans are the different types of home loans, which are available for any individual who wants to buy a home through a home loan. The demand for home loans has risen dramatically in recent years, and individuals have varying expectations when it comes to home loans. A number of banks have come up with the idea of providing different house loan plans to cater to the needs of different sectors of society.

Types Of Home Loans FAQs:

1. Is it necessary to have a good credit score to apply for home loans ?

Because a house loan is a long-term loan with a tenure between 5 to 30 years, lenders want to ensure that their money will be returned in the long run. As a result, the loan sanctioning body will almost certainly verify your credit history before approving a house loan for you. You would be classed as a low-risk borrower if you have a strong credit record or history, and you may be able to receive low-interest rates and exemptions on different bank fees based on your credit score history.

2. What is a floating rate home loan ?

A floating rate home loan is a loan in which the interest rate on the loan varies on a regular basis for the life of the loan.

3. What is a fixed-rate home loan ?

Fixed-rate home loans are a type of home loan given at a fixed interest rate during the loan tenure, which remains constant regardless of market conditions.

4. What are the different types of home loans ?

The different types of home loans are land purchase loans, home purchase loans, home construction loans, home extension loans, home improvement loans, NRI home loans, etc

5. Which banks provide home loans in India ?

A few of the leading banks that provide home loans to individuals include HDFC Bank, Axis Bank, ICICI Bank, State Bank of India and associates, Bank of Baroda, RBL Bank, etc.