Buying a property or a new home is a major part of the Indian dream. Half of our lives are spent thinking about ways to make enough money to own the house that we can call our home. Thus, having all the legal documents required for the purchase of property is important. If you talk to elders in the family they will almost always end up telling you to buy a house, as buying a home, is the ultimate form of investment which is also a means to a secure future.

From a very young age, most of us are psychologically conditioned to work hard, earn enough money and ultimately be able to buy our own house. For some others out there, buying a house or investing in real estate could actually turn out to be a great investment idea.

Ownership Of The Property And Real Estate

Nonetheless, there are certain aspects that should be kept in mind before you start with the paperwork and invest in a property to avoid yourself from being embroiled in legal conundrums and losing not only your dream but also your hard-earned money.

Most often than not, when you set out to buy a house, you must check for details and facilities like hospitals, shopping complexes, parks around or near the house, the location of the property, water and electricity facilities, etc. But that could not be enough? Although these factors are important, it doesn’t always guarantee that a person will get the best deal when it will come to legal issues. So, what’s more important?

Legal Documents Required for the Purchase of Property in India

What Paper Is Required To Own Land?

Before venturing into any new property-related adventure, you must ensure that you check all the legal documents required for the purchase of property that you have finalized and also the legal compliances so that you are protected from any future legal hassles.

The list of legal documents required for the purchase of property that needs to be considered between the buyers and the sellers or looking to buy a property or new home is given as under:

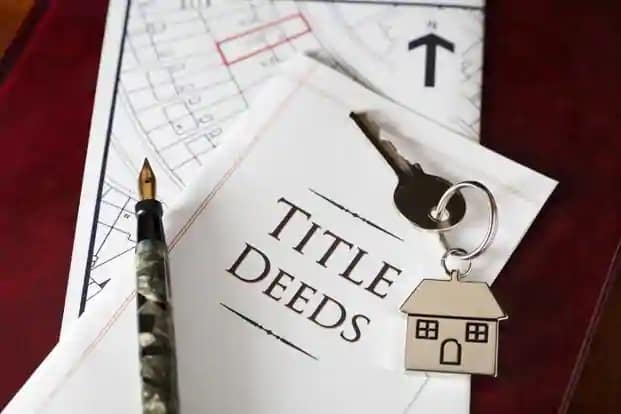

1. Title Deed

1. It is one of the most important documents that is required to own land. As we all know, no one can transfer a better title than he himself has. A seller cannot transfer his/her property to a prospective buyer if the title isn’t perfect and free from any defects or encumbrance. A person who will claim himself as the seller can’t sell the property if the property is not in their name and they don’t hold any good title over the same. The title search of a property can take place at a Sub-Registrar’s office.

2. The buyer will be entitled to receive all title documents of the property and the title document will be asked for properties that are extremely old, title documents that are prepared thirty years prior to the date of the title search need to be traced. The title must be free of any disputes over the ownership of the property.

3. The title deed allows buyers to ascertain ownership rights. The seller should be the actual owner of the property. Before purchasing any property, you should also ascertain whether or not the seller has the ownership of the property or just has the development rights of the property.

2. Encumbrance Certificate

1. It is required to know whether the property that you will purchase is free from any legal dues whatsoever. Like in the case of title search, you can even search encumbrances over the property at the Sub-Registrar’s office. The office will provide all the background about the concerned property, as to whether there is any mortgage, or any third party claim, liens, etc.

2. Utmost care must be taken while buying or investing in a property that is mortgaged. An encumbrance certificate or an EC is an important document that would have a record of every transaction done during a stipulated period of time over the concerned property, for which the EC is sought.

3. The sale deed in duplicate also needs to be submitted for obtaining an EC. A form is required to be filled for obtaining the Encumbrance Certificate and submitted to the nearest Sub-Registrar office.

3. Master Plan

1. More often than not you will come across property sellers or builders who will claim certain infrastructural development at the place where the property is located. Tall claims like schools would be constructed, shopping malls will be built, highways and metros will be constructed often hold no ground and these are merely said to entice more buyers and sell the property.

2. Before buying a property, one should take legal advice and closely scrutinize the master plan of the concerned area, and ascertain for themselves whether these claims will actually see the light of the day.

3. You can procure these master plans of the area from the local town planning department of the city. You must also make it a point to carefully check the land use zone according to the master plan for the property.

4. House Plan Approval

1. you need to ensure that the place where your property is located has also been approved and verify whether the building plan has been approved or not. You must also check to see that no building bye-laws are violated.

2. The building planning and layout should be in accordance with the guidelines of the National Building Code of India. The layout is also required to be in accordance with the norms of GRIHA (Green Rating for Integrated Habitat Assessment).

5. Agriculture to Non-Agricultural Land Conversion Certificate

1. you need to see to it that the plot that you are buying does not come under agricultural land. Any land which is designated as agricultural land cannot be used for residential purposes, it will be rendered illegal if it is done so.

2. Therefore, if you have reasons to believe that the plot you purchase once was an agricultural property, ensure that the conversion certificate is issued (by the seller to the buyer) by the appropriate revenue authorities.

3. A conversion certificate is required to change the purpose of land use from agricultural to non-agricultural. The town planning department of the concerned city also needs to issue a NOC or No objection Certificate for use of agricultural land for non-agricultural purposes.

6. Land Use Certificate

1. Most of you would be aware that it is illegal to construct a property for residential purposes in a commercial zone. You need to apply to the development authorities of the respective city to verify whether the residential property that you are planning to purchase is in the residential zone and not in the commercial, industrial zones, or agricultural.

2. Residential properties must not be bought for commercial purposes without the approval of the urban development authorities. Thanks to “Zoning” you should not be surprised if one fine day you get to know that a plot you bought for residential purposes in a commercial zone and that too without the approval of the authorities concerned and the plot is being demolished by the authorities.

7. No Objection Certificate

1. No objection certificates are to be obtained wherever it is necessary. The seller should provide the buyer with a copy of the urban non-ceiling no-objection certificate and NOCs for electricity, water, etc. as well.

8. Allotment Letter

1. It is one of the key documents needed for getting a home loan. The allotment letter is released by a housing authority or a developer mentioning the description of the property and information about how much money is yet to be paid to the society or builder on account of the said property.

2. It is important to keep in mind that it is not an agreement of sale. It is issued on the letterhead of the authority. A sale agreement, on the other hand, is released on stamp paper.

3. It is issued to the first owner and the owners after that can request a copy of the original from the seller.

9. Commencement Certificate

1. This certificate is one of the mandatory for any construction of a property to commence. This certificate is to be issued by the town planning department after scrutinizing the superstructure, building layout, plan, etc. The builder should also have all the necessary sanctions before he/she sets out to construct.

10. Property Tax Receipts

1. Tax receipts should be checked by the buyer and seller to make sure whether the seller of the property has paid all the taxes accruing on the property for the past 3 years to the authorities. The buyer should ask for earlier receipts of property taxes if the buyer is buying a property that is being resold.

11. Sale Deed

1. Before executing a sale deed, the buyer must ensure that the property is free from title insurance. The sale Deed is one of the most important legal documents. It is the proof between the buyer and the seller that states that the property has been sold and the ownership of property has been transferred from the seller to the purchaser.

2. Before the execution of a sale deed, all charges like property tax, electricity and water charges, housing society charges, and maintenance should be given to the fact that a sale deed needs to be compulsorily registered.

12. Khata Certificate/ Extract

Khata when translated to English means “account”, it is basically the account of a seller or the owner of the property. A Khata extract is necessary for buying or ownership of the property. It is required for not only transferring the property but also for the registration of any new property.

A few the other legal documents that are essential for the builder, as well as the buyers at the time of buying property, are:

- Completion Certificate (CC)

- Power of Attorney

- Probated Will

- Occupancy Certificate (OC) etc.

13.Payment Receipts

This document is necessary for the buyer as well as the seller, as well as the sale of the property. Collect original payment receipts from the developer if you are buying a new property. If you are buying a resale property, ask for a copy of receipts from the seller to be produced to the bank.

14.Property Tax Receipts

Property owners have to pay taxes, so this document is extremely important. Ensure that the previous occupier/owner had paid property taxes and there are no pending due. Property tax receipts also help in proving the legal status of the property.

15.Completion Certificate

For a home loan, it is required to have this document. This paper establishes the fact that the building is constructed according to an approved plan. If you are planning to get the ownership of any land or property, make sure the completion certificate is issued.

16.Occupancy Certificate

An occupancy certificate is issued by the local authority to the developer to establish that the building is finally ready to be occupied and the construction has been done according to where the property is sanctioned.

17.Possession Letter

This document is provided to the buyer by the developer and sets a date on which the latter would grant the former the possession of the property. The original copy of this document has to be produced for getting a home loan.

Final Thoughts – legal Documents Required For The Purchase Of Property In India

Becoming a homeowner is a dream of many people and while they can certainly achieve this dream, it requires a bunch of paperwork. There’s no shortcut to buying a home without the paperwork as it is the law to provide all the necessary documentation. In this guide, we mentioned 17 legal documents required for the purchase of a property. We hope this article helps you get your documents in order before you buy a home.

Legal Documents Required for the Purchase of Property FAQs

1. What are the documents required for buying a house ?

A lot of paperwork is required to buy a house along with bank details, one must note that documents like Completion Certificate (CC), Power of Attorney, Probated Will, and Occupancy Certificate (OC), etc.

2. What is the legal process for buying a property ?

A buyer must note that before buying a property the legal documents must be taken into consideration like bank details, financial status, title verification, sale deed, etc.

3. What are the important property documents ?

Some of the important documents you need to have for a property are financial status, sale deed, extracts, power of attorney, NOC, allotment letter, sale agreement, etc.

4. What are the legal documents for land ownership ?

Documents needed from the developer for land ownership are title deed, Encumbrance certificate, House plan approval, Land conversion certificate by the company, Land use certificate, NOC, Commencement certificate, etc.

5. What are the documents required for real estate ?

Transfer of ownership for real estate requires certain documents like sale deed, RTC extract, Khata certificate, mutation register extract, joint development agreement, power of attorney, NOC, ratification deed.