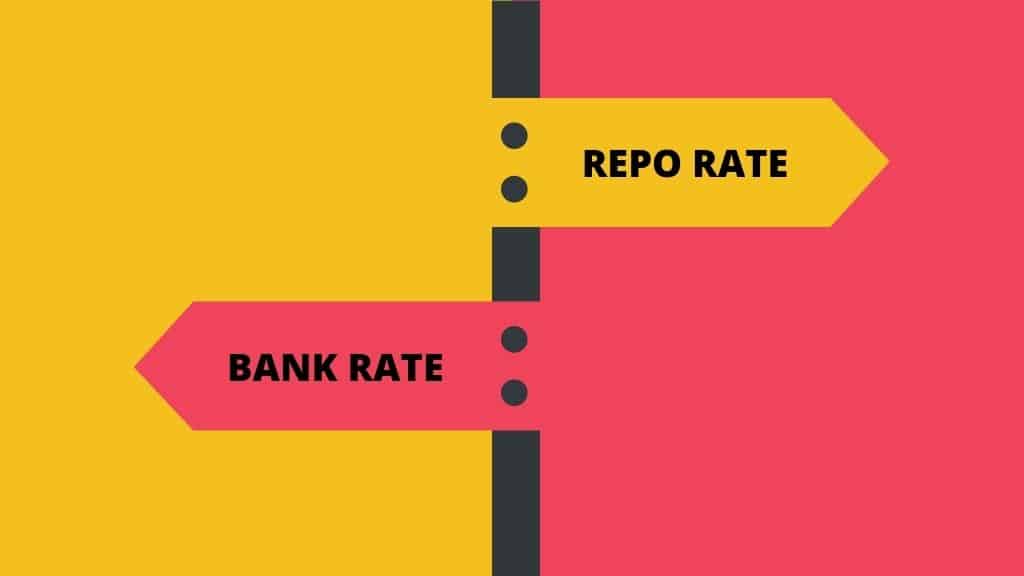

Understanding the Nuances: Bank Rate Vs. Repo Rate

In the intricate world of central banking, two crucial interest rates play pivotal roles in shaping the financial landscape Bank Rate and Repo Rate. Often misconstrued, these rates are distinct in their mechanisms and implications. In this Bank Rate vs Repo Rate blog, we will put them against each other to delve into their nuances and explore the difference between Bank Rate and Repo Rate. But first, let’s start with what is Bank Rate and Repo Rate.

What is Bank Rate and Repo Rate?

Bank Rate

Bank Rate is the interest rate at which the central bank lends funds directly to domestic banks. Bank Rate loans typically do not involve repurchasing agreements or collateral. This rate acts as a benchmark, influencing the interest rates set by commercial banks. It directly impacts liquidity in the financial system and serves as a tool for the central bank to regulate borrowing costs. After the Bank Rate meaning let’s look at the Repo Rate.

Repo Rate

The Repo Rate, short for Repurchase Rate, serves as the interest rate at which central banks, such as the Reserve Bank of India (RBI), extend financial assistance to commercial banks during monetary exigencies. In practical terms, when a commercial bank faces a financial crunch, it approaches the central bank for loans. The transaction involves the bank selling securities to the central bank with a commitment to repurchase them later, thus determining the interest charged by the central bank.

Now that we know the definition of Bank Rate and Repo Rate, let’s get to the Bank Rate and Repo Rate difference.

Differences Between Bank Rate and Repo Rate: Bank Rate Vs. Repo Rate

1. Collateral

Bank Rate:

- Conversely, loans at the Bank Rate are unsecured, with no specific collateral required.

Repo Rate:

- Involves collateral such as bond papers and government securities, providing security for the loan.

2. Tenure

Bank Rate:

- Loans at the Bank Rate, on the other hand, have a longer tenure, usually around 28 days, offering financial institutions an extended period for fund utilization.

Repo Rate:

- Typically has a short tenure, often as brief as one day, facilitating quick liquidity adjustments.

3. Loan Type

Bank Rate:

- Represents a straightforward loan arrangement without needing a repurchase agreement, catering to the long-term monetary goals of the borrowing bank.

Repo Rate:

- Encompasses a repurchase agreement, wherein the borrowing bank sells securities to the RBI with an agreement to repurchase them later. This mechanism addresses short-term liquidity needs.

4. Interest Rate

Bank Rate:

- Features a higher interest rate, compensating for the absence of collateral and the longer tenure of the loan.

Repo Rate:

- Generally boasts a lower interest rate than the Bank Rate, measured in basis points (BPS), where one basis point equals 1/100th of a percentage point.

5. Objective

Bank Rate:

- Targets the long-term monetary goals of a bank, providing a stable and relatively prolonged source of funding.

Repo Rate:

- Primarily functions as a short-term monetary tool, influencing overall liquidity rates in the financial system.

6. Impact

Bank Rate:

- Impacts overall liquidity in the financial system, with a higher rate potentially discouraging borrowing and a lower rate encouraging it.

Repo Rate:

- Changes in the Repo Rate affect short-term borrowing costs, with a cut encouraging borrowing by lowering interest rates, while a hike increases borrowing costs.

7. Also Known As

Bank Rate:

- Often known as the “Discount Rate.”

Repo Rate:

- Commonly referred to as the “Repurchase option” rate.

8. Tenure and Agreement

Bank Rate:

- In contrast, it has a longer tenure with no repurchase agreement required.

Repo Rate:

- Features a short-term tenure with no need for a repurchase agreement.

When we look at Bank Rate vs. Repo Rate, these are the differences.