You might have come across the word ‘Benami’ multiple times (especially when living in India), but what does it mean? Benami in its literal sense is ‘be-naam‘ or ‘without any name’ associated with the thing in question. But, is it true for a property as well?

To have a better understanding, we will focus on what Benami property means and the Benami property act in India in this article below. So, let’s dive in!

What Is A Benami Property?

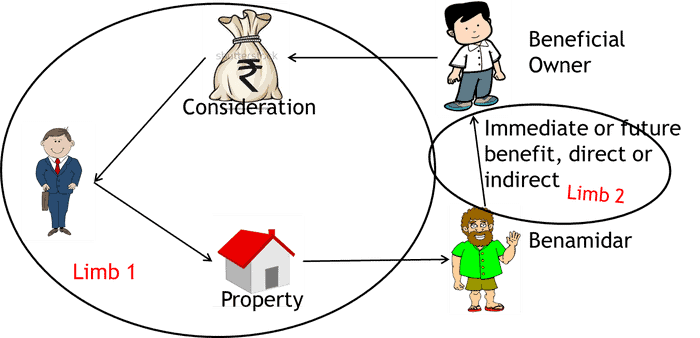

The term “Benami” originates from the Persian language that literally translates into “the state of being without a name.” A Benami property means a transaction or an arrangement, where a property is transferred to or held by a person with consideration for such property having been provided or paid by another person.

This Benami property is received on behalf of an entity that is not the actual owner, known as the ‘Benamidar.’ They, as per the law, are required to pay the tax on their income as they become the legal owner of the land.

In the year 1854, in the case of Gopeekrist Gosain vs. Gungapersuadit, the privy council of the Indian court recognized Benami as part of the Hindu customs even though such transactions were not recognized by England. Hence, in the year 1882, 28 years later, Benami transactions were legitimized by the Indian Trusts Act, Sections 81, 82, and 94. These sections gave statutory protection to Benami transactions by protecting them by a relationship of trust.

What are the Two Types of Benami Transactions?

- A transaction under which a person buys a particular property with his money. However, the name given in the transaction is not his name but a person who is chosen by him. This second person has no intention of benefiting from the transaction. For instance, X sells a property to Y with a sale deed mentioning Z as the Purchaser. Here Z is the Benamidar but the real purchaser is Y.

- A transaction where a property owner executes a conveyance for another person without handing over the said property. In this case, the original property owner remains the sole owner of the porperty. You may call this a sham transaction as here X is selling his property to Y without giving the title of ownership to Y.

The Benami Property Act of India

The original transaction of the Benami Transactions Prohibition Act was established in 1988 with only eight sections of the entire Act. However, recently, in the year 2016, the Benami transactions reform act was amended as the Act itself with 72 sections in it.

In addition to a Benami transaction, the income tax laws also began to attract penalties on the Benami properties. This Benami Transactions Prohibition Act was introduced to suppress illicit and corrupt money, nonetheless, the required rules and regulations were never enforced.

But, as the Benami’s Amendment Act in 2016 was implemented, dealing with the Benami properties seemed possible as the Benamidar were liable to punishment if they took advantage of the law, unlawfully.

What Benami Transactions are Excluded From Being Rendered Illegal?

Here are some examples of Benami transactions that cannot be rendered illegal:

- The property is held by a member of a Hindu undivided family for the benefit of the family while the consideration for such property has come out of known sources.

- A person with fiduciary capabilities such as an agent of a depository under the Depositories Act, 1996, a depository, a director, a partner, an executor, or a trustee of a company, and any person notified by the Central Government for the said purpose.

- Any person who is purchasing in the name of their spouse or child with the property’s consideration being paid out of known sources of the said person.

- Any person purchasing in the name of their siblings or a lineal descendent or ascendent where these people’s names appear as joint holders with the consideration of the said property being paid out of known sources of the particular person.

What Are The Laws Of The Benamidar Under Whom The Property Is Held, In The Name Of A Benami Transaction?

Listed below are a few responsibilities held under the Benamidar of the Benami property:

- If the legal owner or the Benamidar owns more than a single property, then the notional rent that is applied would be according to the income tax laws

- If income in these properties cannot be owned, then the legal owner must provide with their income as a Benami transaction on such properties

- The Benamidar are liable and can be held accountable for the penalty under the Revenue Tax law if they happen to conceal or show fake evidence before income tax authorities.

How Do The Courts Know The Transaction Made is a Benami Transaction?

The points mentioned below are not conclusive of a Benami transaction but indications of such a transaction having been taken place:

- The conduct of the involved parties while dealing with the property after its sale.

- The custody of the title of the ownership of the property after the sale.

- The position of both the parties and the relationship between the alleged Benamidar and the claimant.

- The motive of proceeding with the transaction as a Benami transaction, if any.

- The possession and nature of the property after its purchase.

- The source of the money used for the purchase of a property.

What Are The Consequences Of A Benami Transaction?

The legal owner of a property that is held for punishment by the law by the adjudicating authority will either face:

- Imprisonment from a year up to 7 years and/or with be liable to pay a fine of up to 25% as per the fair market value of Benami property

- Confiscation of the property by the central government.

- There could be a re-transfer or a prohibition of the property from the Benamidar to the beneficial owner.

What Percentage of Tax is Incurred For a Benami Property?

In a Benami property, the investments are taxed at 60% with a surcharge of 25% and education cessation of 3%. After which, the tax liability will amount to 83.25% of the value of the investment of the property.

What Are The Penalties Of Benami Transaction Under The Benami Act?

Confiscating the land from the owner of the property is the basic penalty under the Benami Transaction Act. Other than that:

- There could be 1 to 7 years of imprisonment with 25% of the property’s fair market value to be levied if avoid paying statutory dues or preventing payment

- In case of false information, one is liable for an imprisonment of 6 months to 5 years and up to 10% of the property’s fair market value

What Are The Key Modifications Rendered By The Benami Law Reform Of Real Estate?

As the Benami Property Transactions Act was forced back in 2016, it didn’t really show any potential impact on most investors. However, listed below are the key modifications that were rendered by the law:

The change in the punishment – According to the old Benami rule, as for punishment, only the Benami property in question was confiscated by the Government. However, in the new law of 2016, if a property is deemed as “Benami,” it gets invested with the government without any notice and the legal owner is liable to pay a fine of up to 25% of the fair market value for the property along with imprisonment for up to 7 years.

The change in the transactions – The new Benami Law now covers the transaction that was earlier provided by the children while the property was held by the family on behalf of the father/mother as a sign of respect.

The government can attach the land – If an innocent buyer buys a Benami property from a Benamidar, the government could attach the land irrespective of if you’ve paid a considerable fee from declared and established sources.

The Bottom Line: Definition of a Benami Property

The conditions of the Benami Amendment Act, 2016 vis a vis what a Benami property is and its exceptions are comprehensive but those conditions are subjective to the real intention of the original owner of the property in concern. Section 2(9)(A)(b) says in a Benami transaction, the property is transferred to a third party under the purchaser’s consideration and held for future or immediate benefit. However, this section does not provide the source of the money used for the transaction by the purchaser. It mainly tends to ascertain the intention of the legislators while considering the transaction in totality.

FAQs: Concept Of Benami Property In India

1. What are the punishments under the Benami act?

(On the other hand, for a person who is required to provide information under this Act provides false information:

● Imprisonment from 6 months to 5 years with fines up to 10% of the fair market value of the property)

2. What is a fair market value?

According to section 2(16), the fair market value of a property on the date of the transaction means the price of the land on sale in the open market with no ascertainable price.

3. What is Benami Property?

Anything that has been a subject matter of the Benami transaction is a Benami property. This could also include the consideration received from a property.

4. What is a Benami transaction?

It is a transaction where a property is transferred to or held by a person. And, the consideration for such properties has been provided or paid by another person.