Owning a property in India comes with the responsibility of paying property taxes to the municipal corporation of different cities. Property tax is not fixed throughout the country and it varies from one state to another or from one city to another. The property taxes are fixed by the municipal corporations of different cities.

Just like all taxes, property tax is enforced by the government to generate revenue for public purposes. You need to know how to calculate property tax on land, how to calculate property tax on personal property, and also how to calculate property tax on a house before paying it to the municipal corporation of different cities.

What is Property Tax ?

Property tax is the yearly amount that is paid by a landowner or a property owner to the municipal corporation of the local government. Property tax includes all touchable real estate properties such as an individual’s house, office building, and the property that is rented or let out.

In India, Property Tax is payable only on property that is ‘real’, that is, land with and without man-made constructions. The municipal corporation of a city evaluates different categories of properties of a city, to decide on property tax as per its value.

The amount which is collected through the property tax is utilized for the development of the local public infrastructure like maintenance of roads and schools, repairing roads, etc. Property Tax varies between different locations within a city, and between cities and municipal corporations.

What Are The Types Of Property Taxes ?

Properties are classified to help the municipal corporation categorize the process of evaluating taxes based on certain criteria. Property taxes in India have been divided into 4 classifications.

- Personal property tax: Tax imposed on personal property such as cars, buses, and other vehicles.

- Property tax on land: Tax imposed on the land in its elementary form, free of any form of construction.

- Property tax on improvements and upgrades made to land: Tax which is imposed on man-made constructions on land that cannot be moved like buildings.

- Property tax on intangible property: Taxes that are imposed on property that is not in its tangible forms such as royalties and patents.

What Are The Factors To Be Considered While Calculating Property Tax ?

- The state or municipal corporation, type of property, etc.

- Calculation methods that vary among different municipal corporations

- Accurate details based on the locality, the status of occupancy – rented or self-occupied, type of property – land, residential, commercial, infrastructure offered floor and carpet area, number of floors of the construction, etc.

- The tax amount can be automatically calculated on the municipal corporation website when you mention the required details accurately.

How To Calculate Property Tax ?

The property tax is not fixed as a whole in India and it varies from different locations, cities, and states. Hence, different tax collecting bodies such as municipal corporations have different ways to determine the property tax.

There is a general guideline regarding the calculation of a property tax throughout the country and the method to calculate property tax is calculated by using the property tax calculator formula.

Property Tax = Base Value x Built-Up Area x Age Of The Property x Type Of Property x Category Of Usage x Floor Factor.

What Are The Different Methods To Calculate The Property Tax ?

- Capital Value System: As per the capital value system, the property tax is calculated on the market value of the property that is decided by the municipal corporation based on where the property is located. A percentage of the market value is estimated as the property tax to be paid by the property owner.

- Unit Area Value System: The unit area value system determines the property tax on the grounds of the per-unit price of the built-up area across the property. The price of the property, in this case, is decided based on factors such as land price, usage of the property, and its location. As the price is estimated, it is multiplied by the built-up area covered on the property.

- Annual Rental Value System: Annual rental value system is also known as the rateable value system. As per this method, the property tax is collected based on the rental value of the property that is collected each year. The rent is not the actual amount collected by the owner; it is the rent estimated by the municipal corporation based on the location and size of the property.

Apart from these, the distance of the property to the amenities and landmark places such as markets, malls, and transport stations like bus stops, railway stations, and airports is also a key factor in deciding the rent of the property.

What Are The Methods To Pay Property Tax ?

Property tax can be paid on both offline methods and online methods, as per the convenience of the property owner. Below is how you can pay property tax using the two methods.

1. How To Pay Property Tax Offline?

To pay your property tax offline, you need to go to the office of the municipal corporation of your city. Also, you can pay a property tax on the designated bank branches. Offline payments of the property tax can be made through cash, cards, and checks.

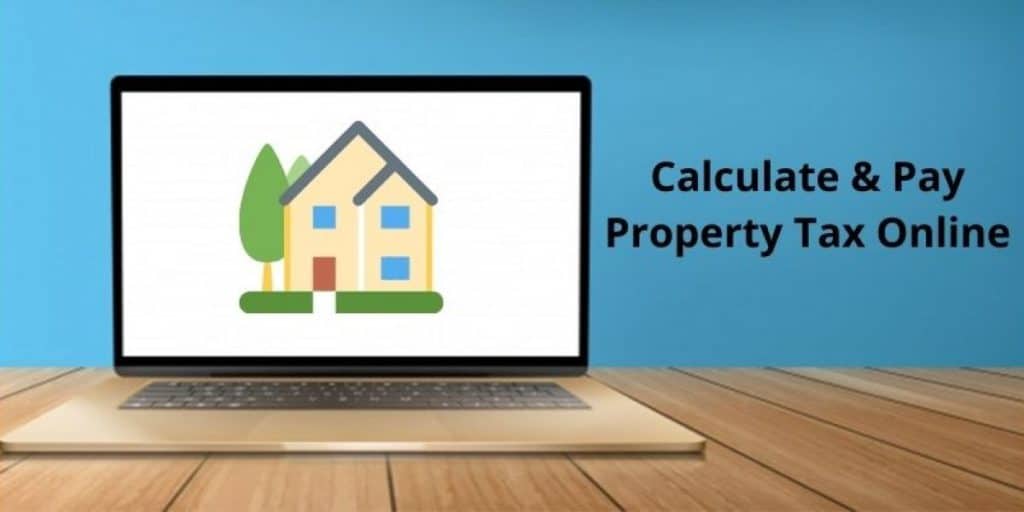

2. How To Pay Property Tax Online?

The online method of paying property tax has made it very easy for people to make their tax payments, irrespective of the time zone or location. Most of the municipal corporations in India provide this service, making the process hassle-free.

If you prefer paying your tax online, here are the steps you need to follow. These are the standard steps for online payment of Property Tax and may be different for certain city or town corporations.

- Log in to the official website of the municipal corporation of your city, town, or state.

- Select the option ‘property tax’ and move to the payments option.

- Further, fill in the right property tax form, that is the form 4 or form 5, based on the type of property and the category.

- While you fill the form, choose the assessment year, that is the year for which the tax is to be calculated and paid.

- Proceed further to fill in the property identification number, property documents, and other required information such as the owner’s name.

- After filling in all the required information, move further, by selecting the mode of payment, amongst the options provided such as debit/credit cards or net banking.

- On successful payment, a challan is generated on the screen. Take the printout of the generated challan for future references.

What Are The Guidelines To Pay Property Tax Online ?

- If there is a balance after you have paid your tax in advance after adjusting the dues from the previous years, you will be paid back through DD or cheque post verification.

- Property tax for a particular financial year will include the pending amount or remaining dues from the previous years.

- If you opt to pay the property return for the existing financial year in two installments, you can use the same form to pay the second installment as well.

- If you opt to pay the entire tax amount in one installment, you will be eligible for a 5% rebate.

- Payment of the backlogs for the previous years can be made only after the challan for each of the previous years has been generated.

- Receipt for payment through cash and DD is generated instantly, while receipt for payment through cheque will be generated only after the cheque amount has been realized.

- An interest of 2% per month is calculated automatically on the tax amount for the defaulted period.

What Is The Interest Rate Of The Property Tax ?

The interest on property tax is charged when an individual fails to pay the property tax on time. A penalty charged on property tax is equal to a certain percentage of the amount of the taxes due. Also, the property tax charged from the property owner varies from one municipal corporation to another. However, in general, the percentage of property tax ranges from 5% to 20%. At times, various states and municipal corporations tend to waive off the interest rate on property tax in certain situations.

What Are The Types Of Property Tax Deductions Against Income ?

Deductions from income on house property, as mentioned under Section 24, are applicable in the following circumstances –

- If you reside in the only property that you own, there will be no income from the house property. Income received in the form of rent and value of additional houses received annually will be subjected to tax after deductions made under Section 24.

- If you are the owner of more than one property, the net annual value of the same, barring the house in which you reside, will be considered as your income.

- In case you offer your house or houses on rent, the rent received is considered as your income.

1. Deductions under Section 24

If you own property in India, you will be eligible for two kinds of deductions under Section 24 of the Income Tax Act. They are:

- Standard Deduction: If you are a taxpayer, you can enjoy an exemption when the income you receive from your house is 30% of the net annual value. In that case, this income is not taxable. However, this is not applicable when you reside in the house that you own.

- Interest on loan: The interest that you pay on the principal amount of your home loan for purchase, renovation, or construction is exempt from taxes. The interest is the amount that you pay over and above the principal amount.

2. Exemptions Under Section 24

- If you do not reside in the house for which you have taken a loan, you will be eligible for exemption on your entire interest. There is no upper limit for the exemption.

- If you do not reside in the house for which you have taken a loan because you stay in another city as a result of your occupation or business, or you occupy another property you own or have rented in the same city where you are employed, you are eligible to claim exemption on your interest of nothing more than INR 2 lakh.

- The purchase or construction of the house has to be completed within 3 years of opting for the loan for you to be able to claim the maximum deduction of INR 2 lakh on the interest amount.

- You should ask for an interest certificate for the loan that you have opted for so that you can submit it as proof for the verification process during the calculation of tax deductions.

Final Takeaway

One must note that the property tax is not fixed as a whole in India and it varies from one city to another or from state to state. The municipal corporations of different cities fix the rate of property taxes. The methods used to fix the property tax are based on capital value, unit area value, and rental area value.

How To Calculate Property Tax FAQs

1. Is property tax and house tax the same ?

A property tax is a broader concept that covers the tax collected on various types of real estate properties such as commercial, residential or institutional properties. A house tax is specific to the tax collected from the owners of residential premises that is a house.

2. How many times is the property tax paid ?

A property tax is an annual charge which is paid once by the property owner to the concerned authority.

3. Who pays property tax in India ?

The property tax is paid by the owners of the real estate properties, such as land, house, or commercial premises.

4. Who should pay property tax for rented properties ?

The owner should pay property tax for rented properties and not the tenant.

5. Do all municipal corporations provide online tax payment options ?

Online payments are a new concept in India. Not all municipal corporations provide this option. You need to officially confirm with your respected municipal corporations whether you can avail of the online payment facility.