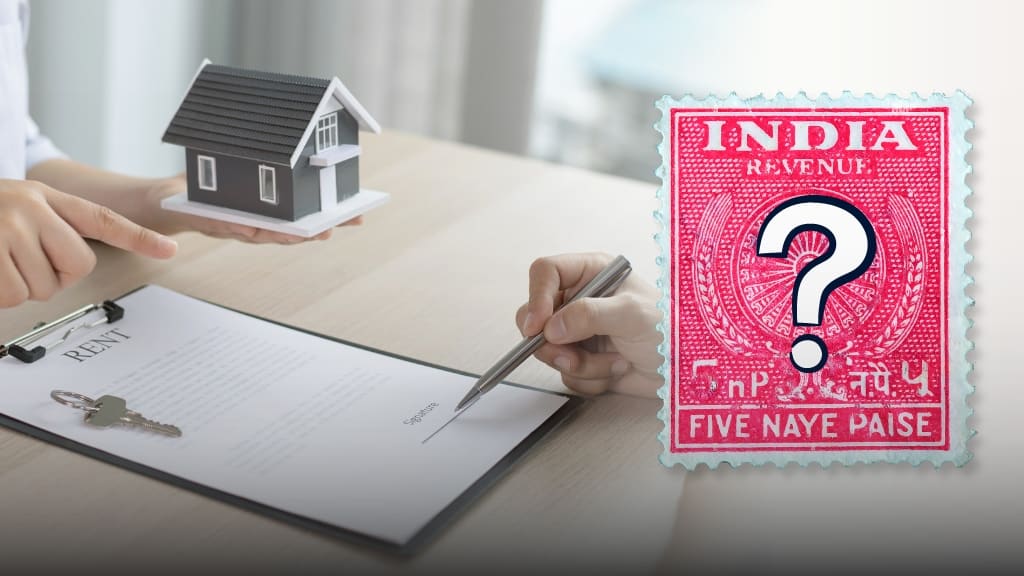

Ever signed an important document and been asked to affix a revenue stamp? Many people are unaware of its significance, often leading to confusion about its necessity and usage. Without proper understanding, overlooking this small yet crucial detail can lead to disputes or invalidation of agreements.

A revenue stamp plays a vital role in authenticating financial transactions and ensuring legal validity. This article delves into what a revenue stamp is, its purpose, and why it’s essential for securing agreements and receipts.

What is a Revenue Stamp? Where to Get it?

As per the Indian Stamp Act of 1899, a stamp refers to any seal, mark, or approval by any person or agency duly authorized by the state government. The stamps are either impressed or adhesive for collecting chargeable duty as per the Act. This Act has been revised 51 times between 1899 and 2004.

The purpose of revenue stamps is to collect income or fees to maintain courts. If you make a payment of Rs. 5000/- or more, you can ask for a stamped receipt with a 1 Re. revenue stamp according to Section 30.

When is the Revenue Stamp Needed?

A revenue stamp is needed when a receipt includes writing, a memorandum, or a note such as:

- Exchange bill, receipt of money, or a promissory note.

- Receipt of movable or personal property to satisfy a debt.

- If a debt or demand has been discharged or satisfied.

Where Can I Purchase a Revenue Stamp in India?

To buy a revenue stamp in India, you have to go to your local post office and it costs Re 1 for every stamp. However, nowadays they are also available online and in other local shops, but they sell them at a higher price. We recommend buying a stamp from the post office to stay away from getting counterfeit stamps.

Is Revenue Stamp Required for a Rent Receipt?

Yes, a revenue stamp is required for a rent receipt. If you rent a house and your salary has a home rent allowance, you’ll need to furnish rent receipts to claim tax deductions as per Indian Income Tax rules. While claiming the tax benefits, you have to provide confirmation of the rent paid to your landlord according to the rental agreement.

This is why rent receipts are important as they are proof that you used a certain part of your salary for rent. If you receive HRA in your yearly salary, your employer would need this legal confirmation to calculate the due tax and claim deductions from your side. Before the fiscal year ends, your employer will ask you to submit your rent receipts with an affixed revenue stamp.

You should get invoices from your landlord and then use a revenue stamp on it even if you use a credit card or online methods to pay your rent. Also, you must remember that a rent receipt with an affixed revenue stamp is only required if the rent is more than Rs. 3,000. You don’t have to show a rent receipt if the rent is lower than the mentioned amount. Also, you don’t have to provide your rental agreement to claim the HRA benefits.

What are the Legal Documents Needed With the Rent Receipt?

A rent receipt becomes valid when a revenue stamp is affixed and has the following information:

- Tenant’s name

- Landlord’s name

- Rental Property’s address

- Rental period

- Amount of rent

- Payment Method – online/cash/cheque

- Sign of the landlord

- In case the rent crosses Rs. 1 lac per annum, the landlord’s PAN number must be provided along with the receipt of the rent

- Information about other charges including electricity bill, water bill, and more

- If the rent exceeds more than Rs. 5,000 you should affix a revenue stamp on the rent receipt.

Benefits of Rent Receipts

A rent receipt is a proof that a tenant has paid that rent to the landlord and received a rent receipt in return. The biggest benefit of a rent receipt is that you can claim tax benefits at the end of the fiscal year by submitting important documents to your employer.

Concluding Thoughts:

Revenue stamps have been in India for a very long time. They have been part of the Indian postal service for almost hundred and fifty years. Revenue stamps especially are beneficial for the user because when affixed on a rent receipt, they can help a tenant get tax deductions at the end of the fiscal year.